Empowering Teens with Financial Knowledge

Introduction

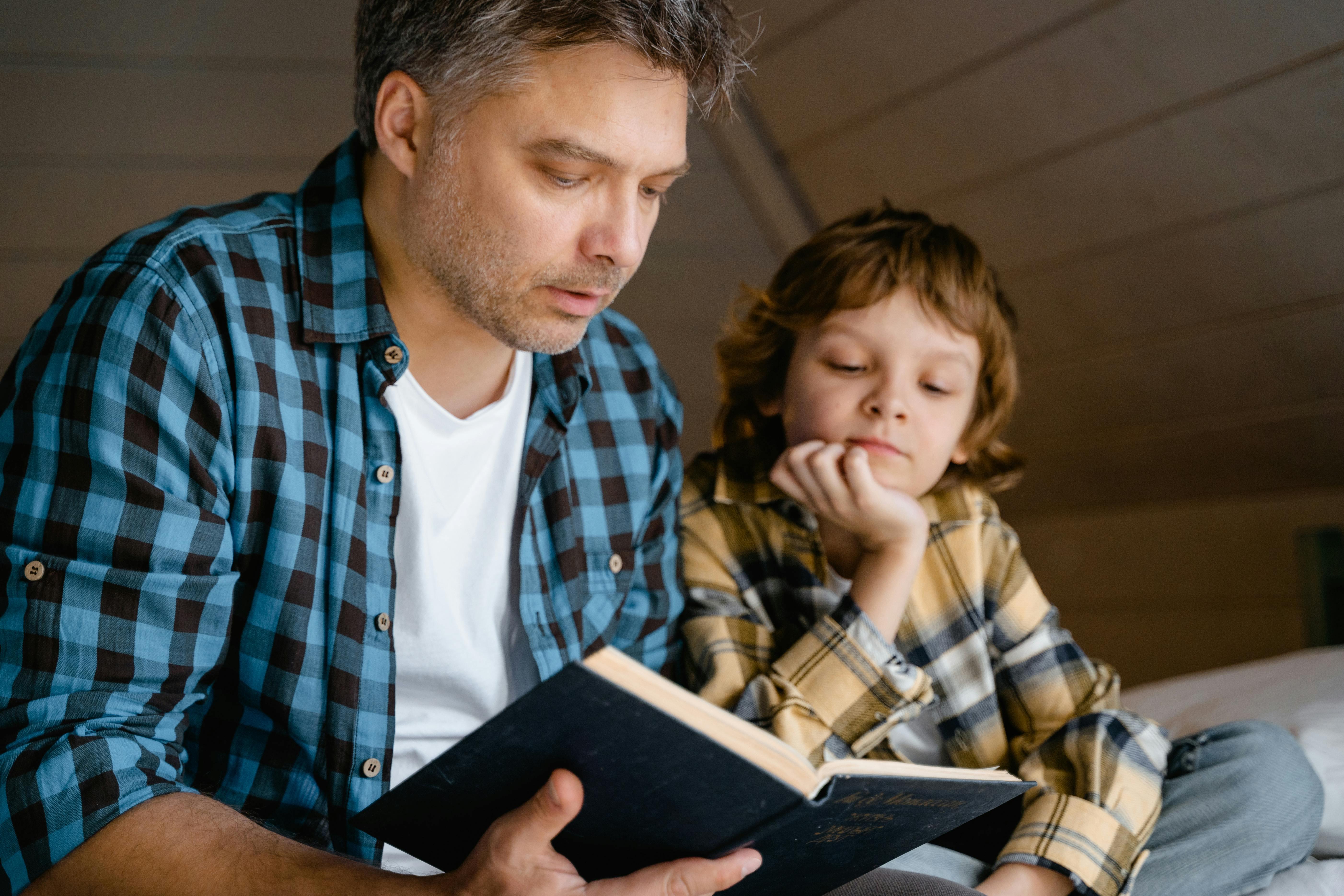

Empowering teens with financial knowledge is one of the most important steps parents can take to prepare them for adulthood. In today’s fast-paced world, understanding money management isn’t just a skill—it’s a survival tool. From budgeting and saving to understanding credit and financial responsibility, teens equipped with these skills are set for a secure and confident future. This guide will walk you through ten essential steps for empowering teens with financial knowledge, offering practical advice and actionable strategies.

Why Empowering Teens with Financial Knowledge Matters

The importance of empowering teens with financial knowledge cannot be overstated. It goes beyond just teaching them how to manage pocket money. It lays the groundwork for financial independence, reduces the risk of debt, and fosters a sense of responsibility that will last a lifetime. By instilling these skills early, you’re setting your teen up for success in an increasingly complex financial world.

![]()

1. Understanding Needs vs. Wants

Helping teens distinguish between needs and wants is a foundational step in empowering them with financial knowledge.

Encourage them to pause before making purchases and ask themselves, “Do I really need this?” Most impulsive buys fall into the category of wants rather than needs.

This habit promotes mindful spending and reduces unnecessary expenses, teaching them to prioritise essentials over indulgences.

2. Budgeting Basics

Budgeting is a critical skill for financial success.

Make it engaging by introducing concepts like “Finance Friday” at home, where you sit together and review income, expenses, and savings goals.

Teach them to allocate their pocket money into categories like savings, spending, and giving.

Budgeting not only provides structure but also instils discipline and a sense of control over their finances.

3. The Power of Saving

Saving is the cornerstone of financial stability.

Illustrate the importance of saving by sharing simple analogies, like the story of the tortoise and the hare.

Encourage them to save a small portion of their money regularly, even if it’s just a pound or two each week.

Over time, they’ll see how small efforts compound into significant results, reinforcing the value of delayed gratification.

4. Credit Wisdom

Understanding credit is essential for navigating adulthood.

Explain to your teen that credit isn’t free money but borrowed funds that must be repaid, often with interest.

Use examples like credit cards or loans to illustrate how credit works and why it’s important to use it responsibly.

Highlight the potential pitfalls of misusing credit, such as debt accumulation and damaged credit scores.

5. Setting Financial Goals

Financial goals give teens a sense of purpose and direction.

Whether it’s saving for a new gadget, a holiday, or their university education, goals make the abstract concept of saving more tangible.

Encourage them to set short-term and long-term goals, and help them break these into actionable steps.

Achieving these goals not only boosts their confidence but also reinforces the value of planning ahead.

6. Charity and Giving Back

Empowering teens with financial knowledge also includes teaching them the value of generosity.

Encourage them to allocate a small portion of their money to charity or community causes.

This not only helps those in need but also cultivates empathy and a sense of social responsibility.

By experiencing the joy of giving, teens learn that financial success isn’t just about accumulation but also about making a positive impact.

7. Building Emergency Funds

An emergency fund is a financial safety net that prepares teens for unexpected situations.

Teach them to set aside a small amount regularly for emergencies, such as replacing a lost item or dealing with unforeseen expenses.

Explain that this habit can prevent financial stress and provide peace of mind, both now and in the future.

8. The Art of Negotiation

Negotiation is a valuable life skill that extends beyond finances.

Teach your teen the basics of negotiation by encouraging them to practice at markets, car boot sales, or even when discussing household responsibilities.

Learning to negotiate not only saves money but also builds confidence and communication skills.

9. Home Economics

Many schools don’t prioritise practical financial education, so it’s crucial to teach these skills at home.

Get your teen involved in everyday tasks like meal planning, grocery shopping, or DIY projects.

These activities teach budgeting, cost comparison, and the value of time and effort.

Empowering teens with financial knowledge through real-world applications makes these lessons more impactful and memorable.

10. Positive Reinforcement and Patience

Empowering teens with financial knowledge is a journey, not a sprint.

Celebrate their small victories, like successfully saving for a goal or sticking to a budget.

Provide constructive feedback when mistakes happen, framing them as learning opportunities rather than failures.

This supportive approach keeps them motivated and fosters a healthy attitude towards money management.

![]()

Conclusion

Empowering teens with financial knowledge is one of the greatest gifts you can give them.

By teaching them essential money management skills, you’re not only preparing them for financial independence but also equipping them to face life’s challenges with confidence and resilience.

At Empowering Teens with Financial Knowledge, we believe in the power of education to transform lives. Our online programmes are designed to provide teens with the tools and knowledge they need to thrive financially and personally.

Start today and invest in your teen’s future. Together, we can build a generation that’s financially savvy, responsible, and empowered.

FAQs

1. Why is financial education important for teens?

Financial education equips teens with the skills and knowledge to make informed decisions about money. It reduces the risk of debt, promotes savings, and fosters independence.

2. What age should I start teaching my teen about money?

It’s never too early to start. Begin with basic concepts like saving and budgeting during their pre-teen years and gradually introduce more complex topics as they grow.

3. How can I make financial education engaging for my teen?

Use practical examples, set fun challenges, and involve them in real-life financial decisions like shopping or planning a budget.

4. What role does online schooling play in financial education?

Online programmes, like those offered by Empowering Teens with Financial Knowledge, provide structured and accessible resources to teach teens essential financial skills in an interactive way.

5. How can I encourage my teen to save money?

Help them set realistic goals and show them how savings grow over time. Providing incentives or matching their savings contributions can also be motivating.

6. What makes Empowering Teens with Financial Knowledge different from other programmes?

We focus on personalised learning, offering interactive resources and practical tools to ensure that every teen gains a deep understanding of financial concepts and how to apply them in real life.

7. How can parents get involved in their teen’s financial education?

Parents can play an active role by discussing money management at home, setting up joint budgeting exercises, and sharing personal experiences about financial successes and challenges.

8. Are there any additional resources provided in the programme?

Yes, our programme includes downloadable guides, interactive workshops, and access to financial planning tools that are tailored to the needs of teens.

9. Can the programme help teens who struggle with financial concepts?

Absolutely. Our approach breaks down complex financial topics into simple, relatable lessons, ensuring every teen has the opportunity to learn and grow, regardless of their starting point.

10. What makes Thomas Kheith Independent School a great choice for financial education?”

Thomas Kheith Independent School provides a tailored approach to financial education, combining interactive lessons with practical tools to empower teens.